Get This Report on Personal Loans Canada

Get This Report on Personal Loans Canada

Blog Article

Personal Loans Canada for Beginners

Table of ContentsPersonal Loans Canada for BeginnersThe Buzz on Personal Loans CanadaNot known Facts About Personal Loans CanadaIndicators on Personal Loans Canada You Should KnowSome Known Factual Statements About Personal Loans Canada

Doing a regular spending plan will certainly provide you the self-confidence you need to manage your money effectively. Great things come to those that wait.Yet saving up for the large points indicates you're not going into financial debt for them. And you aren't paying a lot more over time as a result of all that rate of interest. Trust us, you'll take pleasure in that family cruise or play ground set for the kids way extra knowing it's currently spent for (instead of paying on them up until they're off to university).

Absolutely nothing beats tranquility of mind (without debt of training course)! You don't have to turn to personal fundings and financial debt when points obtain tight. You can be complimentary of financial debt and start making real traction with your money.

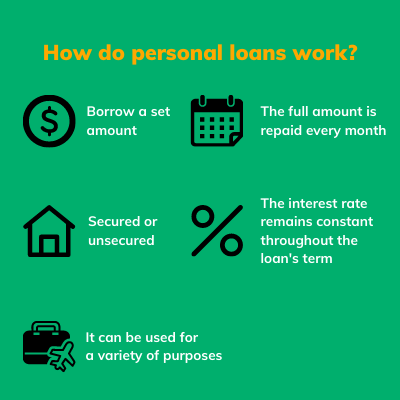

They can be protected (where you provide security) or unprotected. At Springtime Financial, you can be accepted to obtain money approximately car loan amounts of $35,000. An individual loan is not a credit line, as in, it is not revolving financing (Personal Loans Canada). When you're approved for an individual loan, your lending institution provides you the sum total simultaneously and afterwards, typically, within a month, you begin repayment.

The 7-Minute Rule for Personal Loans Canada

A typical factor is to combine and merge financial obligation and pay all of them off simultaneously with an individual financing. Some financial institutions put stipulations on what you can use the funds for, but lots of do not (they'll still ask on the application). home enhancement finances and remodelling loans, lendings for relocating expenditures, vacation lendings, wedding celebration lendings, medical car loans, car fixing car loans, fundings for rental fee, little vehicle loan, funeral finances, or other costs settlements in basic.

At Springtime, you can use no matter! The demand for personal car loans is increasing among Canadians thinking about running away the cycle of cash advance financings, settling their debt, and restoring their credit rating rating. If you're looking for a personal lending, here are some points you need to keep in mind. Personal car loans have a set term, which suggests that you recognize when the financial debt needs to be repaid and just how much your settlement is on a monthly basis.

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg)

Not known Facts About Personal Loans Canada

Furthermore, you could be able to minimize just how much total passion you pay, which means more money can be conserved. Personal finances are powerful devices for accumulating your credit history rating. Payment history make up 35% of your credit rating, so the longer you make normal settlements on time the extra you will certainly see your score boost.

Personal car loans provide an excellent possibility for you to restore your credit rating and repay financial debt, but if you don't spending plan properly, pop over to these guys you can dig on your own right into an even deeper hole. Missing out on among your regular monthly repayments can have an unfavorable impact on your credit history but missing several can be devastating.

Be prepared to make each and every single repayment on time. It holds true that an individual funding can be used for anything and it's easier to get approved than it ever remained in the past. If you don't have an immediate demand the additional cash money, it may not be the finest service for you.

The repaired regular monthly repayment quantity on a personal car loan depends on just how much you're borrowing, the rates of interest, and the set term. Personal Loans Canada. Your rate of interest will rely on elements like your credit report and earnings. Oftentimes, individual lending rates are a great deal less than charge card, yet often they can be higher

Some Of Personal Loans Canada

Advantages include excellent interest rates, incredibly fast handling and funding times & the privacy you might want. Not every person likes walking right into a bank to ask for money, so if this is a challenging spot for you, or you simply do not Full Report have time, looking at online loan providers like Spring is a wonderful alternative.

That mostly depends upon your capacity to settle the amount & advantages and disadvantages exist for both. Settlement sizes for personal car loans usually fall within 9, 12, 24, 36, 48, or 60 months. In some cases longer repayment periods are an alternative, though uncommon. Much shorter payment times have very high monthly settlements but after that it's over promptly and you do not Visit This Link lose more cash to passion.

What Does Personal Loans Canada Do?

You could obtain a reduced interest rate if you finance the loan over a much shorter duration. A personal term finance comes with a concurred upon repayment schedule and a taken care of or floating rate of interest rate.

Report this page